A multi-tenant cloud-ready platform drives market leadership, leveraging modern design paradigms.

The Context

Comviva is a mobile banking solutions provider and caters to over two billion platform users globally. The company’s digital mobile wallet is used by telecom providers to provide financial transaction capabilities on telecom networks largely focused in Africa and Middle East, South America, and Southeast Asia markets. To secure market leadership, the company developed a multi-tenant cloud-ready platform, in partnership with Sahaj Software, to power mobile wallets for various telecom service providers.

The Business Challenge

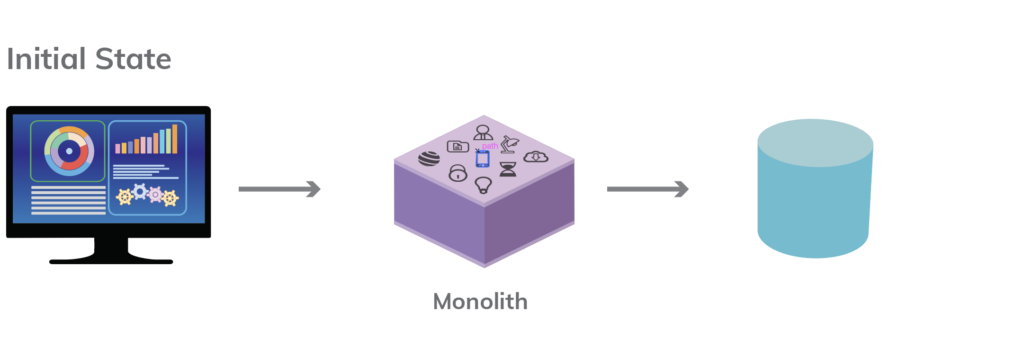

The challenge was to develop a mobile money app to create tailored experiences for each telecom service provider while adhering to regulatory requirements for each of the geographies. Their legacy system was a monolithic one, with more than 35 independent versions in use. The higher cost of maintenance, scalability constraints, and longer cycle times for new features, necessitated a modernized platform. An extension point-based approach was used for customizations, but it could not handle the desired amount of configuration changes, which led to the fragmented code base and product versions specific to each telecom operator.

The Solution

The team decided to do a technological overhaul and give a fresh outlook to solve this complex challenge with a vision to build a scalable platform. We followed a modern approach to design and implemented platform engineering to make the solution future ready with the following features:

- Configuration over customizations: The new architecture was centered around a highly configurable platform that reduced the turnaround time for new deployments from several months or a year to a couple of weeks.

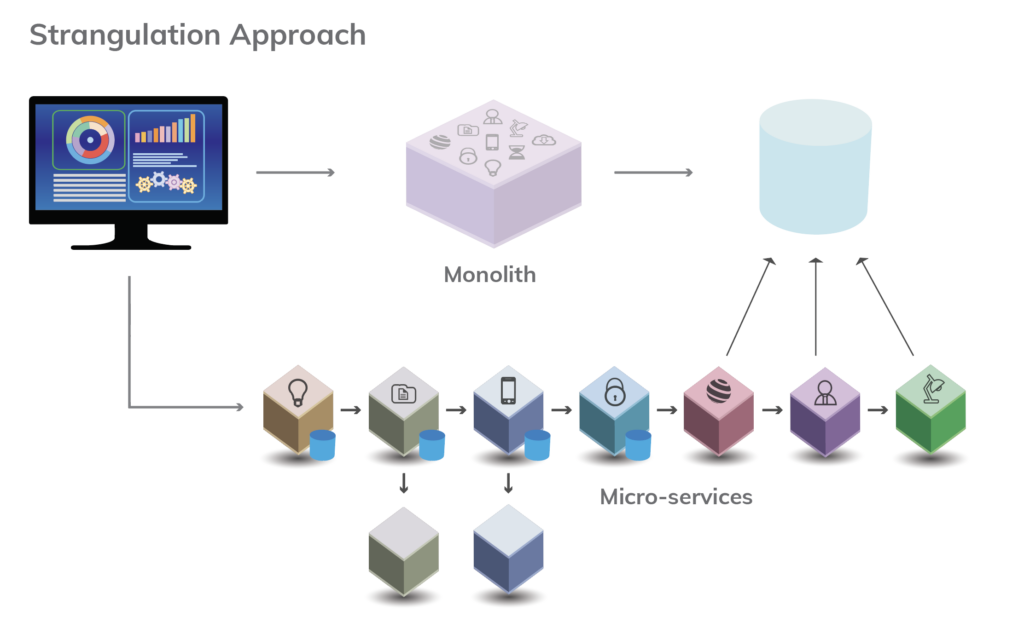

- Strangulation Approach: Employed a transitional strategy, allowing the system’s production use during the shift to a microservices-based platform. This ensured continuity while upgrading to a future-ready architecture.

- Multi-Tenant Capability: Designed as a multi-tenant-enabled platform (specifically for telco’s operating in multiple countries), it facilitates customization without the need for separate deployments, streamlining maintenance and updates.

- Asynchronous Microservices: Utilized Spring Boot microservices, integrated with RabbitMQ for robust messaging, loosely coupled ensuring independent evolution of features/services over a reliable messaging backbone.

- Centralized Configuration and Monitoring: Implemented Spring Cloud Config for centralized configuration management. Employed ELK stack (Elastic Search, LogStash, Kibana) for log aggregation. Monitored system health using Yammer, Influx, and Grafana for comprehensive metrics and circuit-breaking abilities.

The Impact

The development was done using a strangulation approach so that the system can be used in production during the transition to microservices-based platforms. The first month was spent building all the non-functional guardrails; which was followed by the development of a single business process using the platform approach. This helped in the evolution of the platform and the configurability needed. The next 3 months resulted in the development of 8 business processes. The hockey stick effect proved the configurability, provided by the platform and hence realized the primary goal set for the re-architecture work with the following impact:

- Reduced Deployment Time: Reduced the deployment turnaround time for new customers with customizations from several months to a couple of weeks.

- Rapid Response Time: Achieved a remarkable response time of under 250 milliseconds, meeting the primary goal set for the re-architecture effort.

- Performance Enhancement: The new system demonstrated an average response time of 250 milliseconds, handling 480 transactions per second. This represents a more than four-fold improvement from their previous system.

- Cloud Provider Agnostic: Since the product needed to be deployed in heterogeneous environments the architecture was cloud agnostic. It was deployed on prem as well in the cloud. It could support low volume clients with a fraction of the cost that was required for some of the largest deployments with millions of users.

This platform and digital transformation not only optimized performance but also established a foundation for future scalability and innovation, positioning the platform as a front-runner in the mobile banking domain for Comviva.